- Published on

Here's How AI Can be Bearish for Tech Stocks

- Authors

- Name

- John Hwang

- @nextworddev

Rapid AI Advancement is Bearish for (Most) Tech Stocks

With AI that approaches AGI levels, every tech company - big or small - will have their "Google moment" in one way or another. Rapid adoption of AI increases execution risk for tech companies, which in turn increases risk premiums and discount rates (risk premium) for holding equity. The faster AI advances, the more bearish it is for your average tech stock.

Post ChatGPT’s release, the gut reaction of many was to buy MSFT, NVDA, C3.AI (ahem), and the broader tech sector. After all, if AI takes over the world, how could you lose money buying tech, especially the self-proclaimed “AI / Data companies”?

But does AI (especially GPT-4+) actually help tech stock valuations, especially SaaS? In this article, I argue that rapid AI adoption is actually bearish for incumbent tech stocks, mainly because 1) AI challenges the usage-based, recurring revenue model, and 2) increases the risk of disruption/strategic mishaps. AI has forced the hand of tech companies to innovate even faster, and adaptability will come at a huge premium. This will have negative implications for the tech job market. And the faster the AI space moves (which is already breathtaking), the more bearish AI will be for the average tech stock - especially the unprofitable or high P/E ones. Companies like Amazon, which employed 5,000+ engineers to build Alexa, will be under greater scrutiny.

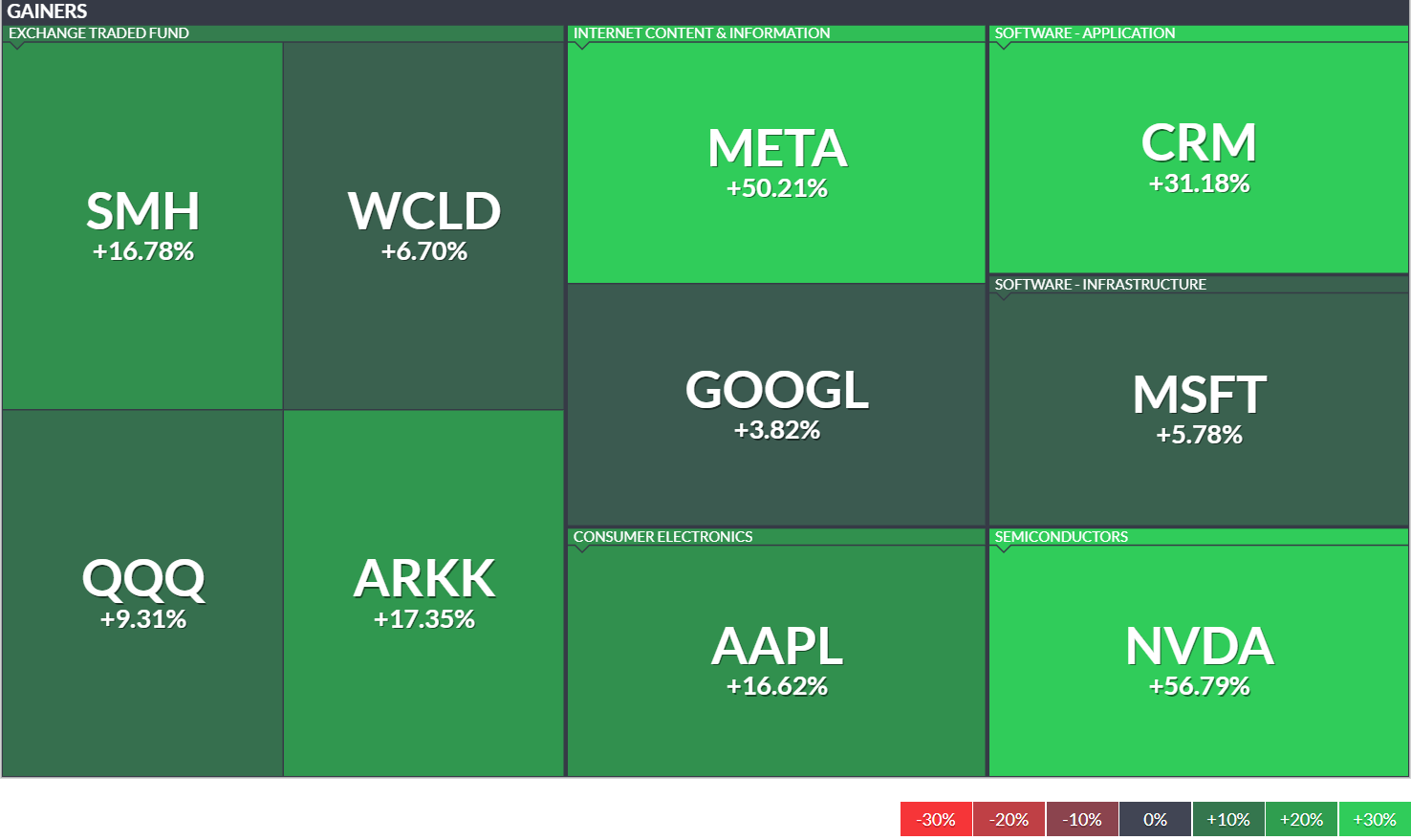

Before I get to the “why”, here’s how to play this “AI headwind” to your advantage. The effects of AI will be felt via greater dispersion of returns among tech stocks, like how NVDA is up 57% ytd versus ARKK only up 17% (as of 3/13). This dispersion effect will only grow stronger with time, and though it has started to play out, the dispersion should continue for many years. This means there will be greater need for tech investors to be stock pickers.

Note, I am not selling all tech stocks should be sold, or for you to quit your tech job - the baseline level of valuation is dominated by macro (the Fed, inflation), and this can offset the “AI headwind”. The point is to bet on increased dispersion, and that AI will make dispersion much sharper than previous mega cycles (post Dot-Com, etc). And given tech stocks are still up 10%+ ytd due to hopes around Fed pivot, there’s still many opportunities to bet on this dispersion.

YTD Returns for Select Tech Stocks - Showing High Dispersion

Why AI Can Be a Headwind (and Stock Picker’s Dream)

Let’s start by inspecting how public SaaS, IaaS companies make money. Their business models are predicated on some projectable, recurring, and constantly increasing consumption / seat value / net retention - all of which is thrown out of the window by the advent of near-AGI - this makes it very hard for them to capture any incremental AI value-add.

Here’s a thought experiment - if you had GPT5 (which let’s say is deployable and usable on your phone) - how would that impact which software you or your business keeps? What would that mean for the quality and quantity of open source alternatives, when the marginal cost of writing software goes down by 10 fold, and free / low code solutions are abundant? What if all that can be deployed on-prem, and no ingress / egress to cloud is needed?

By nature, AI tends to be deflationary for code - as it captures more logic in parameterized memory. This - in a steady state - hurts usage based business models prevalent in software that need a constantly growing Net Retention and seats to thrive. One might think that this gives incumbent tech companies with deeper integrations with customer sites. But even if that happens, it’s unlikely that software vendors will have more pricing power in the future.

To elaborate the reasons for “AI headwind” thesis:

- It’s one thing to create a lot of value with AI, and capturing & monetizing that value. And when you add a real, all-inclusive intelligent agent like ChatGPT V2 (let’s say) into the picture - with a lot of emergent functionalities - now every software category has a higher level to execute at - and this is especially true if that ChatGPT V2 is open source and deployable in the consumer’s device. How much extra can the business actually capture unless it’s basically holding customer data in hostage?

- The speed of AI landscape change is so quick, that it makes long term cashflow projections difficult (from buyer’s perspective), which means lower incentive for very long enterprise commitments (barring very steep price discounts). This means less cash flow visibility, which should lead to lower valuations.

- LLMs are basically “blackholes” of resources, which collapse both code and data into a single model - and though this may be expensive to train, it may be cheaper “globally” to run. In other words, LLMs may reduce the aggregate amount of compute and storage resources consumed globally (counting human capital). At the minimum, and may even reduce (or skew) the amount of storage and compute consumed across the board. Sure, it’s going to be super expensive to train and deploy GPT-6, but it will also save resources from being consumed by inferior software elsewhere… And yes, GPT models can be expensive in inference time, but it may still be magnitudes cheaper compared to human capital.. How would all these factors distill down to SaaS and IaaS company bottom lines? I’d argue that a single “super model” can save on resources at the aggregate system level, which might lead to less $ globally.

- Super advanced LLMs that can run locally might shift data & compute gravity back to “on-prem”, which should hurt cloud revenues. This sounds ridiculous, but here’s a thought experiment: imagine a near-AGI level GPT (GPT-4.5, let’s say) that can be run on your Macbook, which isn’t completely unimaginable. Then the “gravity” of compute may shift from your cloud-based SaaS or IaaS providers, to your personal device. And how would that gravity shift distill down to the company’s bottom line? Sure, OpenAI’s cloud based model might still be better your than on-prem versions, but will that difference still matter perceivably in 2, 3 years? Of course, many factors are at play here, but stock valuations can be very forward looking.

- If AI does succeed in reducing the demand for white-collar workers, then that means fewer “seats”, which hurts usage-based or seat-based pricing. Fewer seats ⇒ less revenue, and this is bad for SaaS companies! And if the seats disappear, will they ever come back? And how many SaaS companies really have any pricing power these days? Sure, we can debate whether AI can replace jobs, but this leads to the next point, which is. Note, if this triggers mass unemployment or deflation, then the Fed may of course start QE again and that might prop stocks up.

- Companies are under pressure to cut costs in 2023 and 2024, and companies are already looking at AI to replace SaaS subscriptions, too. Is your software capable of delivering more value than ChatGPT at a lower price point? Companies that do simple aggregation of information or provide a thin layer of workflows are especially at risk. Oh, you are going to integrate ChatGPT into your SaaS app? Cool, but why should we pay you $199 a year for that?

All in all - every tech company will have their “Google moment” - one way or another. Rapid AI adoption increases the risk of execution risk for tech companies, hence increasing risk premiums and discount rate (risk premium) for holding equity. Think of how Google stock reacted to ChatGPT - as AI adoption spreads, investors should demand a higher risk premium for other tech stocks as well. And higher the discount rate, lower the stocks should trade. This is especially true for Software “pureplay” companies and SaaS. Investors have started to demand an “AI strategy” for every company, and most of them unfortunately don’t have the requisite talent to execute.

Now, let me be clear, none of this matters as much as the moves in inflation, employment, or the Fed policy cycle - but the effects of strategic mishaps will propagate via relative performance of tech stocksover multiple earnings cycles and the re-pricings will inevitably happen. Arguably the re-pricings already happened, judging by the divergence between $ARKK (+18% ytd) and $NVDA (up 60% ytd).

This makes it easier to build a bearish case against the already beaten down small cap, unprofitable tech companies - as well as inflexible and overpriced large cap (e.g. Amazon). Getting AI enabled apps into the hands of customers is not cheap - and companies with the most capital, distribution, and concentration of AI research talent will maintain an even greater edge over the smaller public tech companies (which are often the least profitable).

@nextworddev